Warning : This is just a test...

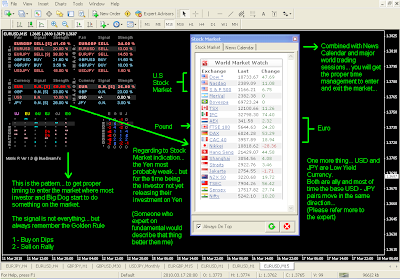

This is just statistically way to analyze chart by using simple calculation. Please refer the above picture.

This is just statistically way to analyze chart by using simple calculation. Please refer the above picture.

The equity market can impact the currency market in many different ways. For example, if a strong stock market rally happens in the U.S., with the Dow and the Nasdaq registering impressive gains, we are likely to see a large influx of foreign money into the U.S., as international investors rush in to join the party. This influx of money would be very positive for the U.S. dollar, because in order to participate in the equity market rally, foreign investors would have to sell their own domestic currency and purchase U.S. dollars. The opposite also holds true: if the stock market in the U.S. is doing poorly, foreign investors will most likely rush to sell their U.S. equity holdings and then reconvert the U.S. dollars into their domestic currency - which would have a substantially negative impact on the greenback. This logic can be applied to all the other currencies and equity markets around the world. It is also the most basic usage of equity market flows to trade FX.

Understand the conditions + Instinct = Right Decision Making

Understand the conditions + Instinct = Right Decision Making

Risk aversion is a concept in economics, finance, and psychology based in the behavior of humans (especially consumers and investors) whilst exposed to uncertainty.Risk aversion is the reluctance of a person to accept a bargain with an uncertain payoff rather than another bargain with a more certain, but possibly lower, expected payoff. For example, a risk-averse investor might choose to put his or her money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high returns, but also has a chance of becoming worthless.

http://en.wikipedia.org/wiki/Risk_aversion

Risk appetite, by contrast, is likely to shift periodically as investors respond to episodes of financial distress and macroeconomic uncertainty. In adverse circumstances, investors will require higher excess expected returns to hold each unit of risk and risk appetite will be low—it is the inverse of the price of risk. And when the price of risk is taken together with the quantity of risk inherent in a particular asset, the expected return required to compensate investors for holding that asset is the risk premium.

I've modified the FullHouse indicator to determine or to captured the sign of Risk Aversion (or Risk Appetite). The yellow arrow come out (refer the above picture) whenever base USD or base JPY suddenly become strong and the movement direction is opposite each other.

p/s The version not yet release. Stay tune.

"A trend reversal signal implies that the prior trend is likely to change, but not necessarily reverse. This is very important to understand. Compare an uptrend to a car traveling forward at 30 m.p.h. The car's red brake lights go on and the car stops. The brake light was the reversal indicator showing that the prior trend (that is, the car moving forward) was about to end. But now that the car is stationary will the driver then decide to put the car in reverse? Will he remained stopped? Will he decide to go forward again? Without more clues we do not know."

Sponsor Links

Real Money Doubling Forex Robot Fap Turbo - Sells Like Candy!